The Rise of Private Credit: Wall Street’s Quiet Power Shift

For most of modern financial history, lending was the banks’ business. JPMorgan, Citi, and their peers intermediated capital between investors and borrowers, taking fees and managing risk. When companies outgrew their bank lines, they turned to the public bond markets. That was the established order.

However, over the past decade, something unexpected has happened. A parallel financial system has emerged that bypasses Wall Street’s traditional gatekeepers and shifts the balance of power toward a handful of alternative asset managers. This system is private credit, and it is growing fast enough to challenge the primacy of banks themselves.

From Crisis to Opportunity

The roots of private credit’s rise lie in the wreckage of the 2008 financial crisis. Regulatory reform — Basel III in Europe, Dodd-Frank in the U.S. — imposed strict capital requirements on banks, limiting how much risk they could hold. At the same time, central banks pushed rates near zero. The result was a vacuum. Borrowers still needed capital, but banks couldn’t supply it. Investors, starved for yield, began to look elsewhere. Alternative asset managers seized the moment, offering to lend directly and bypassing banks, tailoring covenants, and charging spreads above public markets. What began as opportunistic middle-market lending is now scaling into a multi-trillion-dollar asset class.

The Scale of the Shift

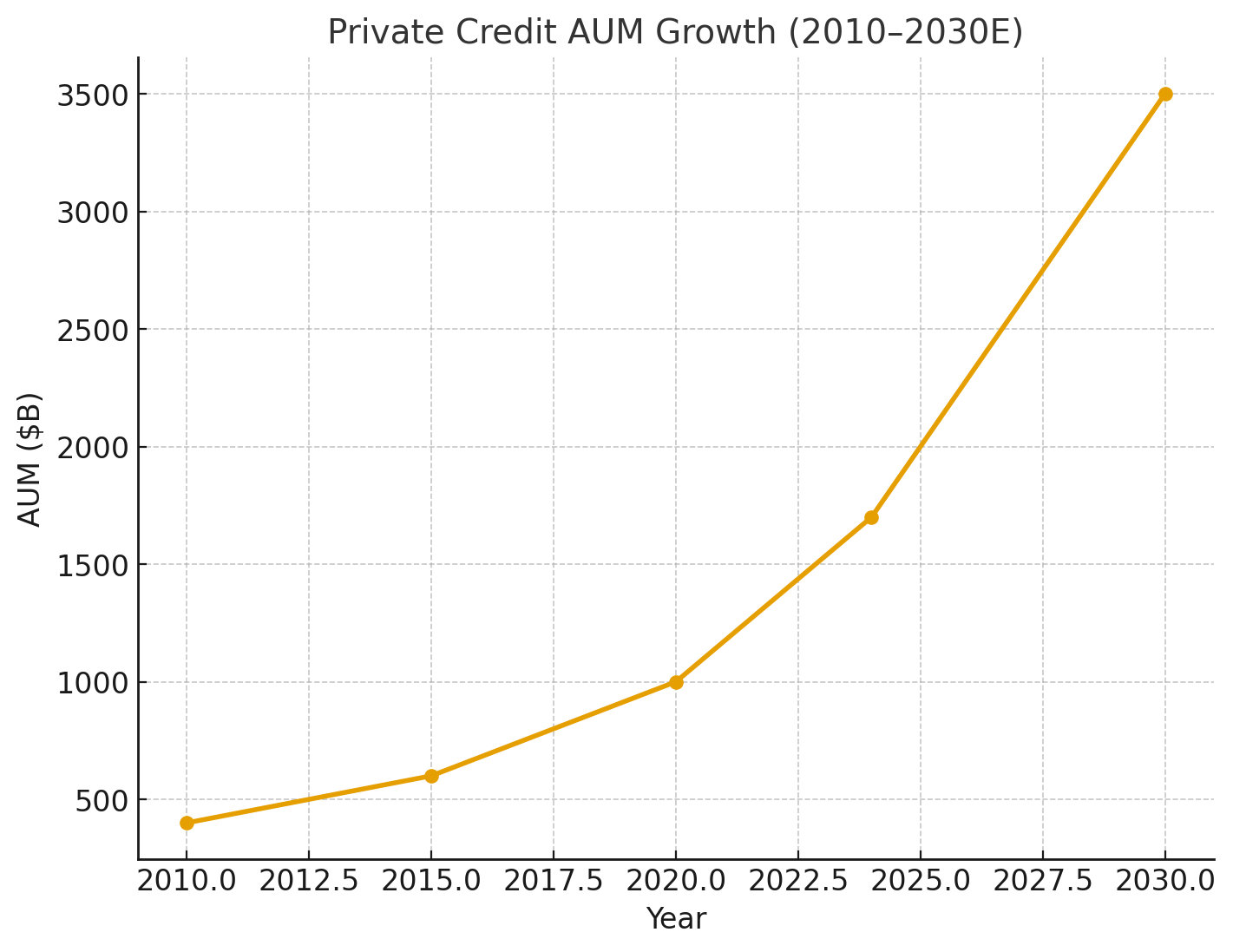

Private credit has grown nearly 5x since 2010.

This trajectory (see chart) underscores how institutional capital, such as pensions, insurers, and sovereign wealth funds, is reallocating away from bonds and into alternatives. In many ways, private credit today is where private equity was in the early 2000s: scaling fast, institutionalizing, and increasingly impossible to ignore.

Why Borrowers Are Switching

The appeal for corporations is clear:

Speed: Deals close in weeks.

Flexibility: Loans tailored to specific needs.

Discretion: No public filings, no market signaling.

Certainty: Large managers can underwrite billion-dollar checks without syndication risk.

In volatile markets, execution certainty often outweighs the marginal cost of capital. That’s why even Fortune 500 firms are now turning to private credit instead of traditional bond markets.

The New Gatekeepers

The up-and-coming financial titans are no longer just banks, but alternative managers:

Apollo (APO): ~$450B credit AUM, advantaged by Athene’s $250B+ insurance float.

Blackstone (BX): ~$300B, pivoting into mega-deals once dominated by Wall Street syndicates.

Ares (ARES): ~$250B, the pure-play credit house with deep PE sponsor ties.

KKR, Carlyle, Oaktree: All scaling rapidly, though still behind the leaders.

Together, these firms now act as private gatekeepers to capital.

Outperformance vs. Markets

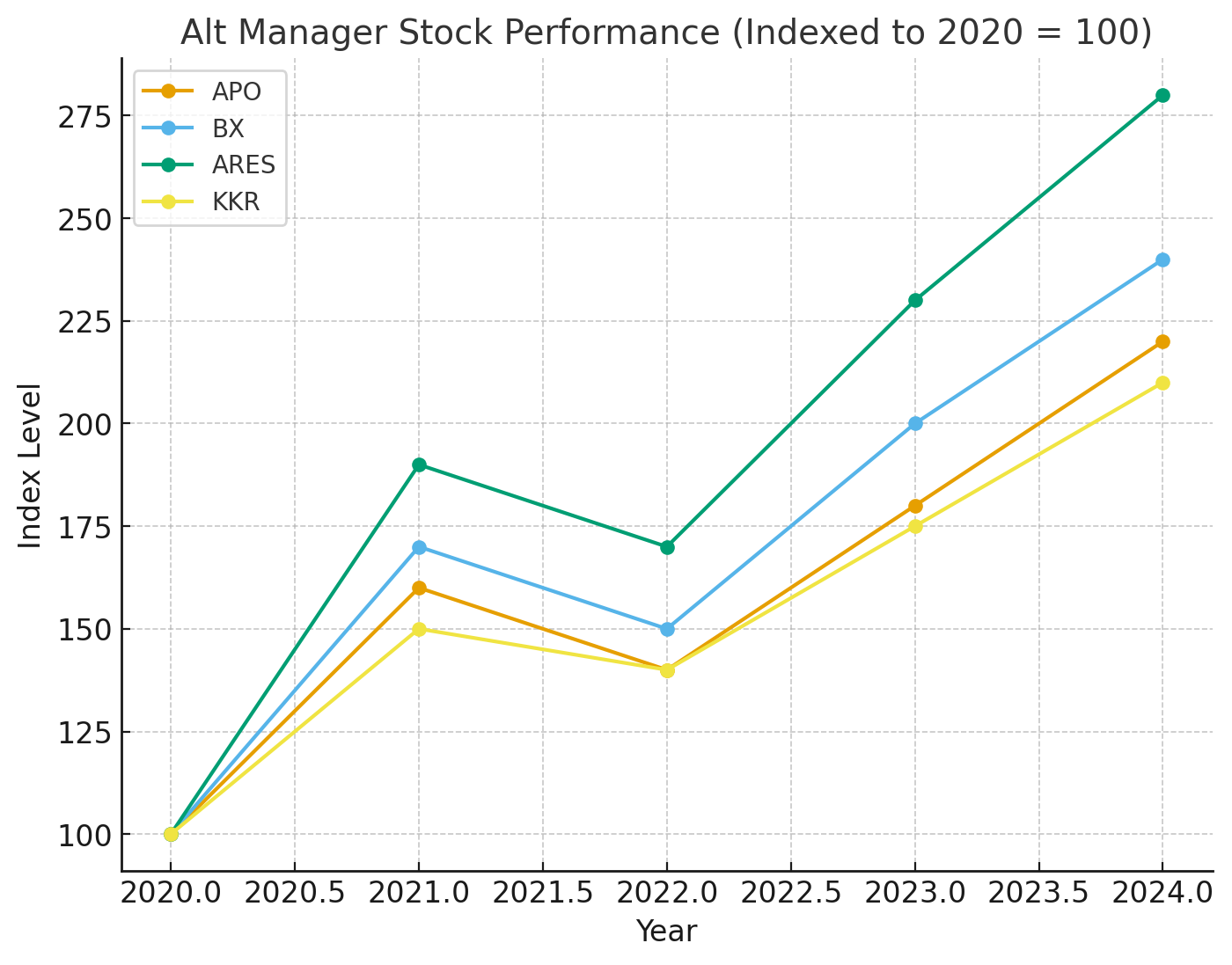

Alternative managers have massively outpaced traditional indices over the past five years.

ARES has delivered the most explosive performance, reflecting investor appetite for direct exposure to private credit growth. BX has compounded steadily on brand and scale, while Apollo’s lower multiple may signal underappreciated upside.

Risks and Fragilities

Private credit is not bulletproof:

Liquidity: Loans are illiquid compared to HY bonds.

Default risk: Prolonged high rates could strain leveraged borrowers.

Concentration: A few firms dominate, raising systemic concerns.

Regulation: Policymakers are already circling — the SEC has hinted at increased oversight.

The first true default cycle in private credit will be the sector’s defining test.

Forward Scenarios

To frame the future, here’s a scenario analysis for 2030:

Even in the downside case, the industry still grows meaningfully. The base case points to sustained double-digit fee-related earnings growth, a rarity in financials. The upside implies that alt managers cement themselves as the rivals of the de facto banks.

The Macro Implications

The implications extend beyond credit markets:

Banks: Risk disintermediation in their core corporate lending franchise.

Investors: Gain access to high-yielding, floating-rate assets previously inaccessible.

Systemic risk: Credit allocation is increasingly concentrated in a few firms’ hands.

The key strategic question: will regulators allow private credit to keep expanding unchecked, or will they fold it into the same capital regime that governs banks?

Equity Angle Outlook

Private credit is no longer a side pocket of private equity — it’s becoming the spine of corporate finance. The opacity is both its strength and its Achilles heel, but the secular growth trend is undeniable.

For investors, listed alt managers aren’t just PE firms. They are the new global lenders of last resort. Their stocks represent leveraged exposure to a structural power shift in global finance.

If ETFs rewired equities in the 2000s, private credit is now rewriting the rules of debt in the 2020s. But unlike ETFs, this revolution concentrates power into the hands of a few. That concentration is both the risk and the opportunity.